| economy

Fed Announces Unlimited Borrowing

[more]

Economic Globlization and Speculation Coming Home to Roost

|

With the current economic crisis which seems to be spreading across the world we are dealing with far more than a “subprime” crisis, or an attempt to “quarantine “toxic debt.” There is a much bigger avalanche waiting to come tumbling down. Namely the derivatives market now estimated to be over $1 quadrillion (that is 1,000 trillion) in global derivatives holdings. That makes the current $700 billion bailout look like less than a drop in a very large bucket.

As the long predicted crash started unfolding, I have been nagged by a long sequence of events that seem to be culminating at the current moment. There have been significant structural changes in the U.S. and elsewhere that have impacted both labor markets, and capital. In terms of labor markets (also known as workers) the transitions have been stark. In the United States we have watched the long term decimation of the manufacturing sector and a transition to a “service” economy. I remember the concerns in the 1980’s about the transformation of the U.S. economy from a production economy to a consumer economy. This trend was accelerated with broad implementation of corporate-driven globalization and formalized by the passage of NAFTA (North American Free Trade Act) and the rewriting of GATT (General Agreement on Tariffs and Trade).

These two international trade agreements were structured along similar philosophies. Namely the removing of “boundaries” to trade, and enhancing the “boundaries” around workforces. Those boundaries were national boundaries and national sovereignty. We saw the exportation of U.S. job (outsourcing and off-shoring) accelerate. We also started seeing the merger mania of the 1980s which have continued to the present. In fact, they are a prominent feature of the current crisis.

Other nations, in a competitive and revolving fashion, became the cheap, exploitable labor force for a global economy. China, maximizing on its single most abundant resource (people) successfully positioned itself as the cheap workforce for global corporations searching to always maximize profit. (Now they too import even cheaper labor).

All along this path towards removal of boundaries, there has been increasing financial and investment penetration in an increasingly intertwined global financial market.

| |

[more]

thanks to Culture of Life News

The Nausea Express

by Jim Kunstler

|

The G-7 world, the club of "developed" western nations plus Japan, has commenced an ordeal of suddenly waking up much poorer. All the desperate work-arounds being engineered by governments and central banks on an al fresco basis are intended to overcome this stunning basic fact, and none of them will. The benchmarks of everything are in flux -- stocks, bond values and yields, commodity prices, most especially currencies -- but these tend to disguise the basic fact of growing and spreading impoverishment. Is oil priced at $80 a barrel this morning? That's nice. Except if the company that employs you is about to fold up and you face a holiday season of driving frantically around Atlanta in search of another job, which the odds are against you find finding. Or if you're living on a retirement fund that's just lost 37 percent of its value and it's time to fill the heating oil tank.

Iceland is the poster-child du jour for this. The little island nation of about 320,000 souls (roughly half of Vermont's population) lately grew a banking sector that thrived on something-for-nothing finance. In little more than a month, its banks have imploded like mini death stars, leaving Iceland with a pariah currency. Since it has to import just about everything, and it suddenly finds itself unable to pay for imports, the people are stripping the grocery markets of whatever remains there now. You wonder what they will do in two weeks. Ten years from now there may be 32,000 of them left, subsisting on blubber sandwiches.

I exaggerate perhaps a little, but who really knows where all this leads? Here in the USA, the Treasury, enjoying new and seemingly limitless powers of discretionary spending, has begun shoveling dollars into every truck that backs up to the loading dock. The numbers are staggering. In ten days it's reached into the trillions in loans and handouts. Most of this money is getting sucked directly into the black hole of debt and margin calls of one kind or another. This is previously-presumed wealth that is now un-presumed. It's leaving the system, never to be seen again. One useful way of thinking about it is to regard it as our society's previous borrowings against our own future. Thus, we are seeing our future vanish into a black hole -- our future comfort, health, and basic nourishment.

| |

[more]

Rescue for the Few, Debt Slavery for the Many

Congress Should Bail Out of the Bailout

|

We are now entering the financial End Time. Bailout “Plan A” (buy the junk mortgages) has failed, “Plan B” (buy ersatz stocks in the banks to recapitalize them without wiping out current mismanagers) is fizzling, and the debts still can’t be paid. That is the reality Wall Street avoids confronting. “First they ignore you, then they denounce you, and then they say that they knew what you were saying all the time,” said Gandhi. The same might be said of today’s overhang of debts in excess of the economy’s ability to pay. First the policy makers pretend that they can be paid, then they denounce the pessimists as spreading panic, and then they say that of course students have been taught for four thousand years now how the “magic of compound interest” keeps on doubling and redoubling debts faster than the economy can squeeze out an economic surplus to pay.

What has ended is the idea that “the magic of compound interest” can make economies rich without having to work and without industry. I hope we have seen the end of derivatives formulae seeking to make money by playing in a zero-sum game. A debt overhang always ends either in foreclosure of the debtor’s property, or in a debt annulment to preserve the economy’s overall freedom and equity.

This means that the postmodern economy as we know it must end – either in financial polarization and debt peonage to a new oligarchic elite, or in a debt cancellation, a Jubilee Year to rescue society. But when the government says that it is reviewing “all” the options, this reality is not one of them. Treasury Secretary Henry Paulson’s first option was to buy packages of junk mortgages (collateralized debt obligations, CDOs) to save the wealthiest institutional investors from having to take a loss on their bad bets. When this was not enough, he came up with “Plan B,” to give money to banks. But whereas Britain and European countries talked of nationalizing banks or at least taking a controlling interest, Mr. Paulson gave in to his Wall Street cronies and promised that the government’s stock purchases would not be real. There would be no dilution of existing shareholders, and the government’s investment would be non-voting. To cap the giveaway to his cronies, Mr. Paulson even agreed not to ask executives to give up their golden parachutes, exorbitant annual bonuses or salaries.

| |

[more]

The Bailout in Plain English

Speaking in the Tongues of Brokers

|

Any number of cultural historians have noted the American belief that success is a sign of God's favor. And over the past couple of decades he has had a downright love fest with the already-rich. So much so that the richest 400 Americans now have more money stashed away that the combined bottom 150 million Americans. Some $1.6 trillion bucks.

This was accomplished by selling off or shipping out ever available asset, from jobs to seaports, smashing usury and anti-monopoly laws, raiding the public coffers and manipulating the medium of exchange and blackmailing the peasantry regarding common needs such as heath care and energy to keep their asses warm -- to name a few. The ultimate coup was to convince the entire nation that the well being of the rich, meaning the well being of Wall Street, was indeed the common man's well being.

All went well for a while. People went into credit card hock up to their noses in order to provide 26% credit card interest to Wall Street, etc. And when that became untenable, flimsy mortgages were cranked out by the millions ensuring that every American who could hold a crayon could sign to purchase a home. To facilitate this all sorts of shaky 'mortgage instruments' were created -- balloon, (sign here Jeeter, you're gonna flip it in a year and make a hundred K on this house trailer) interest only, and finally negative balance mortgages where you only paid part of the interest and the rest was rolled back into the principal balance. And joy of joys you could refinance a couple of times while the inflated value of these houses was on the way up. Life was good for everybody.

The bill was never gonna come due because, god in his wisdom, had deemed that capitalism would defy the second law of thermodynamics and expand forever. So every time a bank made a mortgage loan of say, $400,000, even though the debtor had never even made a payment yet, the loan was declared a bank asset and another $400,000 was loaned against it. Meanwhile, the Federal Reserve Bank yelled whoopee and printed another $800,000 in currency. Of course at some point the country had to run out of customers, so the loans got easier and easier. No matter that debt is not wealth. Wink and call it that and most folks won't even look up from their new big screen high resolution digital TVs.

Problem was that all the jobs to pay for this stuff were stampeding off toward places in China with names containing a lot Xs, Zs and praying for a vowel. It was becoming clear that the entire economy was running on fumes. In fact less than fumes. It was running on the odor of paper. Mountains of the stuff. Bundles of mortgages and very strange securities and derivatives of unknown origin and value. Paper that stated its own worth and signed by some mystic hand no one could quite identify though the blurry signatures looked to read Greenspan, Paulson and Bernanke.

But there was a rub. Things reached the point where there simply was not anything left to defraud the public out of, nothing left to steal from the nation's productive capability, no matter how much paper Jeeter and Maggie signed for that trailer house, no matter how secure Brian and Jennifer out there in Arlington, Virginia and Davis, California thought they were. So the only thing left to do was steal from future generations of Americans and accept an I.O.U. which the government would happily sign on behalf of the people and enforce. By the wildest coincidence, under the Bush administration this I.O.U. happened to tally up to about $700 billion.

| |

[more]

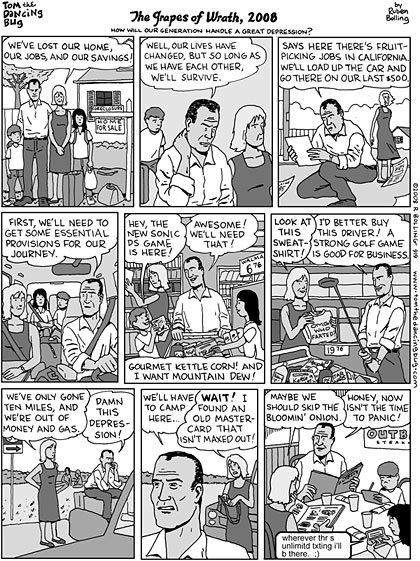

The Grapes of Wrath, 2008: How will our generation handle a Great Depression?

[more]

|