| economy

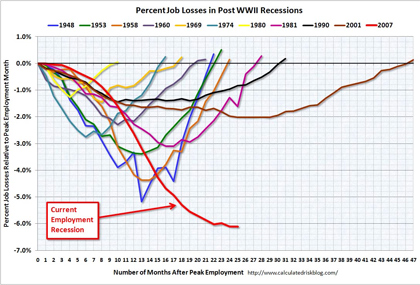

Glad to see things are going so well

Employment Report: 20K Jobs Lost, 9.7% Unemployment Rate

more

James K. Galbraith: "There Is No Return To Self-Sustaining Growth"

'In July of 2009, you signed an initiative of the Roosevelt Institute that seeks an answer to the question: What Caused the Crisis?(ii) May I ask for your personal answer?

'Yes, you may. (laughs.) ó The principal cause of the crisis was the dismantling of the system of regulation and supervision in the financial sector which had for much of the post-war period kept the most dangerous elements of that sector in check. In the absence of an appropriate system of effective supervision and regulation, what happens is that the actors in the system, who are intent upon taking the greatest degree of risk ó including actors who are intent upon using fraudulent methods to increase their returns ó come to dominate parts of the system. As they do that, the general methods of assessing performance in the market, specifically stock-market valuations, become counter-productive. That is to say, they invariably reward the worst actors, while they force more traditional actors, who are still respecting the old norms of conduct, into a competitively disadvantaged position. Thus the bad actors, the fraudulent actors, and the speculative extremists quickly take over.

'That is what happened specifically in the origination of mortgages in the United States in the middle part of the last decade. You had a transition from a traditional method of issuing mortgages to people who could be reasonably expected to service them, to a method of originating mortgages that were sold off immediately, that were rated in a way that permitted them to be bundled and sold to fiduciaries, and where the issuer had no interest in whether the borrowers could pay or not. In fact, in some ways the lenders actively preferred people who did not intend to pay, because they could then inflate the value of the loan and earn a larger fee upfront for doing it. And in this way, not only was there a large segment of the market that was explicitly corrupt, but the equity value of homes all across the country was compromised. When these practices collapsed, so too did the home values not only of people who had bad mortgages, but also those for many people who had good mortgages, good incomes and perfectly good credit.

'The result of that was a general slump in activity. The wealth and financial security of much of the American middle class disappeared. So far about a quarter of the measured wealth of the American middle class has disappeared - about $15 trillion of $60 trillion. Thatís bound to have a fantastically traumatic effect on peopleís consumption behaviour and on their ability to get new good credit. Even if they wish to continue to extend the past pattern of borrowing in order to finance activity, they canít do it. So, this is a very big problem. It starts with a failure to supervise and regulate the financial system, and flows on to the reaction of the broader population, which is to protect their remaining assets, to become extremely adverse to taking ordinary business and consumer risks.'

more

The Free Market Fetish

Garbage In, Garbage Out

"Former Federal Reserve chairman Alan Greenspan answered that he had placed his trust in a flawed theory when he was called before Congress to explain why he, Goldman Sachs Treasury Secretary Robert Rubin and Deputy Treasury Secretary Larry Summers, prevented Brooksley Born, head of the Commodity Futures Trading Corporation, a government regulatory agency, from doing her job of regulating over-the-counter derivatives.

"The efficient markets theory is that unregulated markets are efficient and rational. According to this theory in which Greenspan placed his trust, unregulated markets produce the best possible result. Any regulatory interference worsens the outcome.

"Greenspan blamed his own bad judgment on a theory. The theory, or Greenspanís understanding of it, nevertheless still holds sway as Congress has proved impotent to re-regulate the gambling casino that is Wall Street. Clearly, the theory serves powerful interests.

"But what is the truth?

"The truth is that markets are a social institution. Their efficiency depends on the rules that govern the behavior of people in markets. When free market economists talk about markets deciding this or that, they are reifying a social institution and ascribing to it decision-making power. But, of course, markets do not act or make decisions. People act and make decisions, and markets reflect the decisions and actions of people.

"The entire debate over regulation is misconstrued. It is not the market, an efficient social institution, which is regulated. What is regulated is the behavior of people in markets. If you want good results from markets, good regulation of human behavior is a requirement.

"The market is like a computer. Garbage in, garbage out."

more |