|

Archives

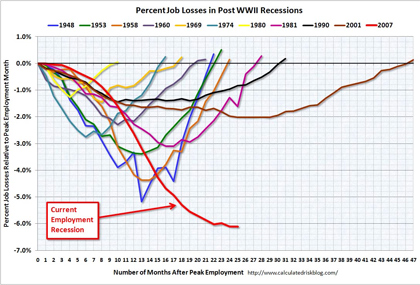

economy Glad to see things are going so well Employment Report: 20K Jobs Lost, 9.7% Unemployment Rate

James K. Galbraith: "There Is No Return To Self-Sustaining Growth" 'In July of 2009, you signed an initiative of the Roosevelt Institute that seeks an answer to the question: What Caused the Crisis?(ii) May I ask for your personal answer? 'Yes, you may. (laughs.) — The principal cause of the crisis was the dismantling of the system of regulation and supervision in the financial sector which had for much of the post-war period kept the most dangerous elements of that sector in check. In the absence of an appropriate system of effective supervision and regulation, what happens is that the actors in the system, who are intent upon taking the greatest degree of risk — including actors who are intent upon using fraudulent methods to increase their returns — come to dominate parts of the system. As they do that, the general methods of assessing performance in the market, specifically stock-market valuations, become counter-productive. That is to say, they invariably reward the worst actors, while they force more traditional actors, who are still respecting the old norms of conduct, into a competitively disadvantaged position. Thus the bad actors, the fraudulent actors, and the speculative extremists quickly take over. 'That is what happened specifically in the origination of mortgages in the United States in the middle part of the last decade. You had a transition from a traditional method of issuing mortgages to people who could be reasonably expected to service them, to a method of originating mortgages that were sold off immediately, that were rated in a way that permitted them to be bundled and sold to fiduciaries, and where the issuer had no interest in whether the borrowers could pay or not. In fact, in some ways the lenders actively preferred people who did not intend to pay, because they could then inflate the value of the loan and earn a larger fee upfront for doing it. And in this way, not only was there a large segment of the market that was explicitly corrupt, but the equity value of homes all across the country was compromised. When these practices collapsed, so too did the home values not only of people who had bad mortgages, but also those for many people who had good mortgages, good incomes and perfectly good credit. 'The result of that was a general slump in activity. The wealth and financial security of much of the American middle class disappeared. So far about a quarter of the measured wealth of the American middle class has disappeared - about $15 trillion of $60 trillion. That’s bound to have a fantastically traumatic effect on people’s consumption behaviour and on their ability to get new good credit. Even if they wish to continue to extend the past pattern of borrowing in order to finance activity, they can’t do it. So, this is a very big problem. It starts with a failure to supervise and regulate the financial system, and flows on to the reaction of the broader population, which is to protect their remaining assets, to become extremely adverse to taking ordinary business and consumer risks.'

The Free Market Fetish "Former Federal Reserve chairman Alan Greenspan answered that he had placed his trust in a flawed theory when he was called before Congress to explain why he, Goldman Sachs Treasury Secretary Robert Rubin and Deputy Treasury Secretary Larry Summers, prevented Brooksley Born, head of the Commodity Futures Trading Corporation, a government regulatory agency, from doing her job of regulating over-the-counter derivatives. "The efficient markets theory is that unregulated markets are efficient and rational. According to this theory in which Greenspan placed his trust, unregulated markets produce the best possible result. Any regulatory interference worsens the outcome. "Greenspan blamed his own bad judgment on a theory. The theory, or Greenspan’s understanding of it, nevertheless still holds sway as Congress has proved impotent to re-regulate the gambling casino that is Wall Street. Clearly, the theory serves powerful interests. "But what is the truth? "The truth is that markets are a social institution. Their efficiency depends on the rules that govern the behavior of people in markets. When free market economists talk about markets deciding this or that, they are reifying a social institution and ascribing to it decision-making power. But, of course, markets do not act or make decisions. People act and make decisions, and markets reflect the decisions and actions of people. "The entire debate over regulation is misconstrued. It is not the market, an efficient social institution, which is regulated. What is regulated is the behavior of people in markets. If you want good results from markets, good regulation of human behavior is a requirement. "The market is like a computer. Garbage in, garbage out."

photography You have to check these out!

america -- a military with a country attached

War, Budgets and Blind Ambition "The American elite's unbounded, unquestioned, indeed unconscious sense of imperial entitlement and dominance -- based ultimately on war, the threat of war and the profit from war -- is one of the defining characteristics of our age. And if you would like to see a glaring example of this attitude in action, look no further than the front page of Tuesday's New York Times, where one David Sanger gives us his penetrating "news analysis" of the Administration's just-announced $3.8 trillion budget.

"Sanger focuses on the huge, continuing deficits that the budget forecasts over the next decade. Completely ignoring the plain truth that his own expert source tell him later in the story -- that "forecasts 10 years out have no credibility" -- Sanger boldly plunges forward to tell us just what it all means. You will not be surprised to hear that the upshot of these big deficits is that neither Obama nor his successors will be able to spend any money on "new domestic initiatives" for years to come. "What is most interesting here, of course, is not Sanger's noodle-scratching over imaginary numbers projected into an unknowable future, but his total and apparently completely unconscious adoption of the mindset of militarist empire. For as he puzzles and puzzles till his puzzler is sore on how in God's name the United States can possibly find any money at all to spend on bettering the lives of its citizens over the next 10 years, it becomes clear that Sanger -- like the rest of our political and media elite -- literally cannot conceive of an end to empire. Our elites and their courtiers literally cannot imagine life without a permanent war for global dominance, fueled by a gargantuan war machine spread across hundreds and hundreds of bases implanted in more than 100 countries."

Seven Days in January "After all, if Gates was blindsided in Pakistan, he already knew that a $626 billion Pentagon budget, including more than $128 billion in war-fighting funds, had passed Congress in December and that his next budget for fiscal year 2011 (soon to be submitted) might well cross the $700 billion mark. He probably also knew that, in the upcoming State of the Union Address, President Obama was going to announce a three-year freeze on discretionary domestic spending starting in 2011, but leave national security expenditures of any sort distinctly unfrozen. He undoubtedly knew as well that, in the week after his return, news would come out that the president was going to ask Congress for $14.2 billion extra, most for 2011, to train and massively bulk up the Afghan security forces, more than doubling the funds already approved by Congress for 2010. "Or consider that only days after his plane landed, the nonpartisan Congressional Budget Office released its latest “budget outlook” indicating that the Iraq and Afghan Wars had already cost the American taxpayer more than $1 trillion in Congressionally-approved dollars, with no end in sight. Just as the non-freeze on defense spending in the State of the Union Address caused next to no mainstream comment, so there would be no significant media response to this (and these costs didn’t even include the massive projected societal price of the two wars, including future care for wounded soldiers and the replacement of worn out or destroyed equipment, which will run so much higher). "Each of these announcements could be considered another little coup for the Pentagon and the U.S. military to count. Each was part of Pentagon blank-check-ism in Washington. Each represented a national security establishment ascendant in a way that the makers of Seven Days in May might have found hard to grasp. "To put just the president’s domestic cost-cutting plan in a Pentagon context: If his freeze on domestic programs were to go through Congress intact (an unlikely possibility), it would still be chicken-feed in the cost-cutting sweepstakes. The president’s team estimates savings of $250 billion over 10 years. On the other hand, the National Priorities Project has done some sober figuring, based on projections from the Office of Management and Budget, and finds that, over the same decade, the total increase in the Pentagon budget should come to $522 billion. (And keep in mind that that figure doesn’t include possible increases in the budgets of the Department of Homeland Security, non-military intelligence agencies, or even any future war-fighting supplemental funds appropriated by Congress.) That $250 billion in cuts, then, would be but a small brake on the guaranteed further rise of national-security spending. American life, in other words, is being sacrificed to the very infrastructure meant to provide this country’s citizens with “safety.” That’s what seven days in January really means."

cameras and lenses

I've started to mount lenses for my 4x5 as my hole saws come in. I'm waiting for the hole saw on this one: An 1869 Voigtlander Petzval. Check out the link for more pictures and information about this beauty. It was, and will be again, a portrait lens.

|

|