|

| |

Archives

|

Saturday September 20 2008

|

cosmic wonder

The Amazing Gift of Woo Lai Wah

|

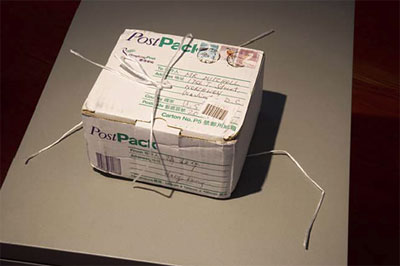

On my way to the basement to do some laundry, I noticed a package on my porch. It was in the usual spot where I ask delivery people to put things if there's no answer to the doorbell. Strange, though. I wasn't expecting anything; everything I'd ordered recently had been delivered.

When I came back upstairs I picked it up. It was for me, not my tenants, and it was from Hong Kong. There was no return address and the customs declaration on the side simply read "camera part." Very strange.

| |

[more]

This is a must read. As Woo Lai Wah said: "It is buddha's meaning to do best things possible for every person on every place."

economy

There were a lot of people running aroung with there hair on fire this week in DC and on Wall Street. It is clear that they either don't have a fucking clue or they are lying through their teeth. The FED and Treasury are looking only to save the collective ass of their buddies on Wall Street with a big fuck you to the American taxpayer. The plan is for all the shit that Wall Street has on their books to be taken over by the government. That would be us. Imagine waking up and finding your house and all your credit cards paid off. But that is only for the rich. More privatizing the profits and socializing the losses. The losses, that we will become responsible for, have become so huge that there won't be any money left over for niceties like Social Security, health care, and repairing roads and bridges. I watched Naomi Klein last night. Her book Shock Doctrine is very timely. You really should read it to see where we are headed. Welcome to Pottersville. The financial house of cards will fall but not until the rich have been protected and then the rest of us will be living in a third-world police state. Fuck the fucking fuckers!

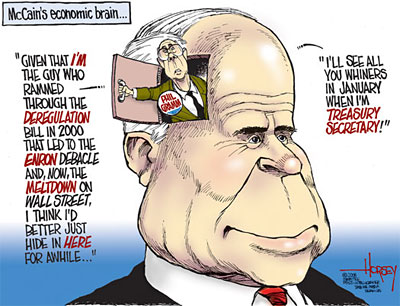

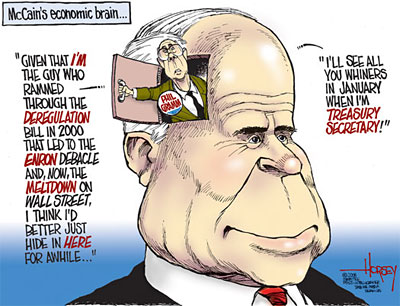

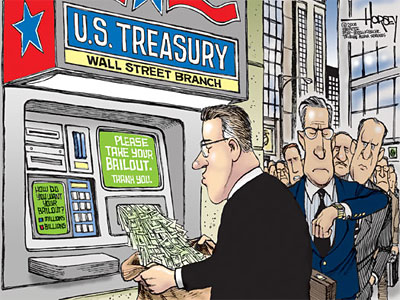

David Horsey

[more]

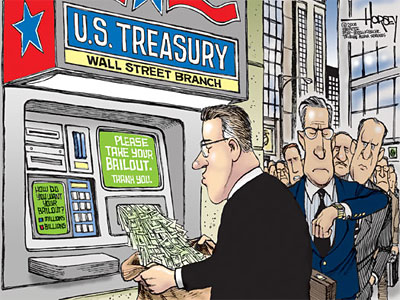

David Horsey

[more]

Tomgram: Steve Fraser, The End of a Gilded Age

|

What is Washington to do as the financial system collapses? Clearly, stark differences in approach as well as in public policy have already emerged. Bail-out Bear Stearns and pump up the brokerage and investment business with new lines of credit. Nationalize Fannie Mae and Freddie Mac on the backs of the taxpayer -- but let Lehman drown. Tell the financial community to save itself, after which Bank of America salutes and buys Merrill Lynch. Then, the Fed gets cold feet and decides it can't let an institution the size of the insurance giant AIG go under as well. Washington is left staring into the abyss. The old rules no longer apply.

And that's the point. At moments of crisis since the mid-1980s, the relationship between Washington and Wall Street has changed fundamentally, at least when compared to anything that would have been recognizable in the previous century. As a result, the road ahead is dark and unknown.

| |

[more]

Congressional Leaders Stunned That Bernanke Finally Admits The Truth

|

Congress was stunned because Bernanke finally admitted the truth (or at least came closer to doing so). Congress ought to be reading blogs rather than listening to clowns like Paulson and Bernanke.

How many times have we heard Paulson the Parrot sing the praises of the strong dollar and the soundness of the US financial system? For more on the "sound banking system" please see You Know The Banking System Is Unsound When.... and Don't Worry, The Banking System Is Sound.

The market called Bernanke's Bluff, and came close to a virtual meltdown.. For now, Armageddon was Postponed as Fed Intervenes In Money Markets.

The list of reasons the financial system is unsound grew massively today, by the tune of a $1.2 trillion taxpayer funded bailout designed to bail out the wealthy at the expense of the poor.

Earlier today Paulson has the gall to state "this will cost the tax payer less than the alternative".

No one bothered to ask why it should cost the taxpayer anything at all.

Furthermore, Paulson once again proved he needs simple arithmetic lessons. Shifting losses from those who should bear them (stock and bond holders of failing companies) to the taxpayers is not going to save the taxpayers a dime, rather it is going to cost them plenty, $1.2 trillion plenty as noted in US Taxpayer: A Giant Dumpster For Illiquid Assets.

The Whole Truth And Nothing But The Truth?

Of course not.

Bernanke did not really admit the truth, he only hinted at it. Congress was too dumb to pick it up. The truth is the US financial system is insolvent.

| |

[more]

US Taxpayer: A Giant Dumpster For Illiquid Assets

|

Paulson, Bernanke, and Congress are conspiring to make the US taxpayer the fall guy for financial stupidity by banks and brokers. Congress is now willing to ram through legislation at the last moment, even though Senate Majority Leader Reid Says "No One Knows What to Do".

| |

[more]

Let Wall Street Burn (the details)

|

At the cost of your future, the U.S. financial system is being saved. For a half century, the United States has been unable to find a hundred billion or so a year to fund general healthcare, but now that financial powerhouses like Bear Stearns, Freddie Mac, Fannie Mae, and AIG are crumbling, the U.S. Treasury can magically procure trillions of dollars in promises without so much as a nit of resistance in either chamber of the U.S. Congress.

Your future earnings have now been committed to saving the asses of the millionaire and billionaires who postured as geniuses as they managed and oversaw the financial follies of the past 28 years. The future potential of your country – and the future potential of your children and grandchildren, is being wasted, now, to save a financial system that subtracts real value from the economy; a financial system that enriches the few by impoverishing the many.

Don’t believe me? There was a very simple, much less costly way to stop the sub-prime mortgage crisis in its tracks. The only thing the federal government needed to do was negate the ballooning interest payments that doubled or tripled mortgage payments, which in turn caused households to begin defaulting on their payments. Bush, or Bernanke, or Paulson, or whoever could have just told the financial sector that they were not going to get their big jump in interest payments on the sub-prime mortgages and that so long as home owners continued to make their payments at their original interest rate, they could not be foreclosed on.

By what authority could Bush, or Bernanke, or Paulson, or whoever do this? Would legislation had to have been passed? Well, tell me this, by what authority are we the taxpayers being forced to extend an $85 billion bailout to AIG literally overnight? What legislation was passed by our Congress that allowed such a massive commitment of our money?

But to have done this, to have forced the banks and mortgage companies and hedge funds that bought the collateralized mortgage obligations to stick with the original interest rates in those sub-prime mortgages, would have been to impinge on their “freedom” to engage in usury. Usury, which was once illegal under the laws of the United States. Did you know that in the late 1800s, the very morality of six percent interest rates was a hot topic of debate?

Let’s be clear here: the financial system is a net drain on the economy. It subtracts much more in value than it adds. The contortions accompanying the disappearance of Lehman Brothers and Merrill Lynch, and the “rescues” of Bear Stearns, Freddie Mac, Fannie Mae, and AIG, do nothing, absolutely nothing, to change the fundamental character of the financial system, which is to -- let’s be frank -- loot the real economy.

| |

[more]

Fixing Wall Street Won't Fix Our Economy

|

Sure, the CEOs and hedge fund managers were greedy. There's no question that wealth and the pursuit thereof led to the sub-prime fiasco and the decline of Lehman Brothers, AIG, Merrill Lynch and more. But what's really at play here is persistent poverty and Wall Street seeking to make a dime off the poor, consequences be damned, while Washington looks the other way.

| |

[more]

As The Market Drops Again, What the Future Holds For Americans

|

But the real important thing to keep an eye on in the short to medium term is not the stock market, it's currency and debt markets. There's currently a flight to "safety" with credit drying up for everybody but governments (even banks are not lending to each other), but really, how safe is anything denominated in US dollars? If you were a foreigner, would you be real easy buying more dollar denominated assets, or even Treasuries? Sure, the government can always come up with more, but how much are they going to be worth? Heck, even if you are an American, and pay for everything in US dollars, doesn't the way the dollar keeps dropping make you queasy?

| |

[more]

Asia Rethinks American Investments Amid Market Upheaval

|

Tremors from Wall Street are rattling Asian confidence, leading many investors to question the wisdom of being invested in the United States to the tune of trillions of dollars.

Asian investors were starting to show hesitation even before the financial earthquake of the last week. Now, a wariness toward the United States is setting in that is unprecedented in recent memory, reaching from central banks to industrial corporations, from hedge funds to the individuals who lined up here to withdraw money from the American International Group on Wednesday.

Asia’s savings have, in essence, bankrolled American spending for decades, and an Asian loss of confidence in American financial institutions and assets would have dire consequences for both the United States government and American taxpayers.

| |

[more]

Federal bank insurance fund dwindling

|

Banks are not the only ones struggling in the growing financial crisis. The fund established to insure their deposits is also feeling the pinch, and the taxpayer may be the lender of last resort.

The Federal Deposit Insurance Corp., whose insurance fund has slipped below the minimum target level set by Congress, could be forced to tap tax dollars through a Treasury Department loan if Washington Mutual Inc., the nation's largest thrift, or another struggling rival fails, economists and industry analysts said Tuesday.

| |

[more]

The Wall Street Model: Unintelligent Design

What's Really Bankrupt

|

Wall Street is collapsing not because of bad mortgage debt or lack of capital or over-leverage. Those are merely symptoms. Wall Street is collapsing because it deserves to collapse; it needs to collapse in order for America to survive. The economist Joseph Schumpeter called it creative destruction, a system where outdated models collapse to make room for new innovation.

| |

[more]

The Point of No Return

|

Following another eratic day of trading on the stock market, Treasury Secretary Henry Paulson and Federal Reserve chairman Ben Bernanke convened an emergency meeting of the Senate Banking Committee and other congressional leaders to request fast-track authority for a sweeping plan to buy back illiquid assets and other complex securities from distressed and under-capitalized banks. The turbulence in the financial markets has intensified and there is every indication that the situation will get worse before it gets better. There are a number of signs that the financial system is at the brink of collapse and that Wall Street is headed for a 1929-type crash. Depositors have begun to withdrawal their savings from money market funds alarmed by the gyrations in the market and the daily deluge of bad economic news. According to the Washington Post, funds dropped "by at least $79 billion, or about 2.6 percent" on Wednesday alone. The withdrawals are the equivalent of a slow bank run just at the time when stressed commercial banks need access to cheap capital to finance daily operations and provide loans for a steadily weakening economy. There's also been a surge of panic-buying of US Treasurys which is considered the safest of investments. According to the Wall Street Journal, during Wednesday's market-rout, "investors were willing to pay more for one-month Treasurys than they could expect to get back when the bonds matured. Some investors, in essence, had decided that a small but known loss was better than the uncertainty connected to any other type of investment. That's never happened before." (Wall Street Journal) Also, the VIX, or "fear gauge", has soared to levels not seen since the crisis began in August just over a year ago.

| |

[more]

photography

This is a test shot with my Pentax Super-Multi-Coated Takumar 50mm/1.4. It's one of the lenses that sat on my window sill for the summer burning out the yellow. A very remarkable lens on a 35mm camera but it takes on very interesting qualities when mounted on my digital Pentax *ist DL. The *ist DL does not have a full frame sensor. It has a 1.5 crop factor. This makes a 50mm lens, which is normal on a 35mm camera, equivalent to a 75mm lens when mounted on my *ist DL. A 75mm lens that can open up to f1.4. One of the problems with zooms is that they are slow. The zoom on my *ist DL is f4.5-5.6. At 50mm it is at the f5.6 end. One advantage of the f1.4 is the ability to use it in much lower light but also, when using f1.4, to have a much narrower zone in focus which allows you to separate the subject from the background, like in the shot above. The 50/1.4 is also legendary not only for it's sharpness but also for it's smooth out of focus areas. The 50/1.4 makes for a very compact portrait lens on the digital *ist DL. I will be playing with this some more!

|

Wednesday September 17 2008

|

the great crash of 2008

It's been a wild couple of days in the financial world. Not only did Lehman Brother's go under but so did Merrill Lynch. And then AIG. And then... The panic continues and will for some time. Politics in the Zeros recommended the following financial blogs. You can't tell the players without a program and, in these times, it's very important to keep up with what is happening. I've read about the beginning of the Great Depression and wondered what it was like living through it as things unraveled. Now I'm finding out.

CalculatedRISK

Mish’s Global Economic Trend Analysis

The Big Picture

Infectious Greed

Naked Capitalism

I would also add: RGE monitor

A Ripe Moment

by Jim "Happy Talk" Kunstler

|

It turns out the real hurricane blew through Wall Street last week, not Galveston. This morning, Manhattan is strewn chest-deep with the debris of banking and at this hour (seven a.m.) nobody knows how far, deep, and wide the damage will spread. The fear, of course, is that we are witnessing a classic "house-of-cards" or "dominos-in-a-row," situation, and that the death of Lehman Brothers and Merrill Lynch will cascade into a generalized collapse of the entire consensus of value that supports mediums of exchange.

At least one thing ought to be clear: this has happened due to the negligence and misfeasance of the regulating authorities, namely the Republican Party, and that now all the hoopla surrounding Sarah Palin can be swept away revealing that group to be what they actually are: the party that wrecked America. I hope one or two Barack Obama campaign officials are reading this blog. You must commence the re-branding of the opposition right now. The Republicans must be clearly identified as, the party that wrecked America.

Many things happening this week will be interesting to see and hear, but just now an outstanding question is how on earth can the Bank of America buy Merrill Lynch for $50 billion after assuming the liabilities of the tarbaby known as Countrywide? But that little detail may be lost in the din as other banks and bank-like organizations start crashing like sequoia trees in a national forest.

I wish I knew whether this extravaganza of ruin might settle the question as to whether America goes into hyperinflation or implacable deflation, but the net effect is that money is leaving the system in big gobs. And if not money per se, then the idea of money as represented in certificates, contracts, counter-party positions, and gentlemen's agreements. This is the day that America finds itself a much poorer nation. The capital we thought was there, is gone.

A lot of it was actually translated over the years into Hamptons villas, Gulfstream jets, and other playthings that will now go up on Ebay or some equivalent as we turn into Yard Sale Nation in a general liquidation of remaining assets. Of course, the trouble in a situation like this, where absolutely everybody is trying to pawn off assets, is that there are very few buyers on the scene, so the prices of all these things go down down down. Everything is for sale and nobody has any money.

| |

[more]

Lehman collapse means all bets for the financial system are now off

|

Any bank harbouring hopes of an end to the credit crunch had a rude awakening today.

Lehman Brothers' bankruptcy has dealt the money markets another crippling blow, incapacitating them for who knows how long. Since the crunch struck last year, the markets have been in seizure. But, with the careful nursing by governments and central banks, they appeared to be on the slow road to recovery. No longer.

Fears about other banks' exposures to Lehman and renewed uncertainty as to where the crisis may strike next will freeze the wholesale markets up again. The crunch is back with a vengeance.

It's not hard to see why. Lehman's collapse into bankruptcy protection is the biggest corporate debt default in history and, in the complex interwoven world of modern banking, no one properly understands where the risks lie.

Wall Street's titans gathered on Sunday afternoon to start the process of working out their positions by sitting down with other banks and tracking the paths of these impenetrable credit structures. It will take months at the very least for them to establish their "naked" exposure.

| |

[more]

thanks to Politics in the Zeros

The transformation of the USA into the USSRA (United Socialist State Republic of America) continues at full speed with the nationalization of AIG

|

Last week we argued that, with the nationalization of Fannie and Freddie, comrades Bush, Paulson and Bernanke had started transforming the USA into the USSRA (United Socialist State Republic of America). This transformation of the USA into a country where there is socialism for the rich, the well connected and Wall Street (i.e. where profits are privatized and losses are socialized) continues today with the nationalization of AIG.

This latest action on AIG follows a variety of many other policy actions that imply a massive - and often flawed - government intervention in the financial markets and the economy: the bailout of the Bear Stearns creditors; the bailout of Fannie and Freddie; the use of the Fed balance sheet (hundreds of billions of safe US Treasuries swapped for junk toxic illiquid private securities); the use of the other GSEs (the Federal Home Loan Bank system) to provide hundreds of billions of dollars of “liquidity” to distressed, illiquid and insolvent mortgage lenders; the use of the SEC to manipulate the stock market (restrictions on short sales); the use of the US Treasury to manipulate the mortgage market (Treasury will now for the first time outright buy agency MBS to manipulate and prop up this market); the creation of a whole host of new bailout facilities (TAF, TSLF, PDCF) to prop and rescue banks and, for the first time since the Great Depression, to bail out non-bank financial institutions; the recent extension of the collateral available for the TSLF and PDCF facilities to a much wider range of toxic securities including equities and thus allowing the Fed to effectively manipulate even the stock market; and a whole range of other executive and legislative actions (including the recent bill to provide a public guarantee to mortgages for banks willing to reduce their face value).

So, with the nationalization today of AIG, comrades Bush, Paulson and Bernanke welcome you again to the USSRA. At least in the case of Fannie and Freddie these two institutions were semi-public to begin with as they were Government Sponsored Enterprises (GSEs). Now we get instead the first pure case of a fully private company, actually the largest insurance company in the world, being nationalized. So the US government is now the largerst insurance company in the world. So the transformation of the USA into the USSRA goes a step further.

| |

[more]

The Federal Government Is Now the World’s Largest Housing Company

|

Socialists could never have done to the market what the free marketers have. The socialization they never wanted done, they're now down on their knees begging for. "Buy us. Please buy us. Save us from ourselves".

As the news that AIG has sold 79.9% itself to the Federal government for 85 billion dollars, Scarecrow wrote to me:

Seriously, this is staggering. The US government is about topurchase and operate as a government entity the world's largest insurance company for $85 billion.

So the US now owns/operates the entities that purchases home mortgages from banks/S&Ls (and owns $5 trillion of that) and the largest entity that insures the transactions that repackages and resells those mortgages.

| |

[more]

Fed Blinks, Offers Lifeline to AIG, Hypocrisy Replaces The Bull As Symbol Of Wall Street

|

During this whole crisis I have come to learn a few things about myself. (I'll get to AIG in a moment.) The main thing I have learned is that I am a lot more of a 'free-market' person than I ever imagined. I shouldn't be surprised, I guess, having lived and breathed markets for 11-plus years. But there is also another reason for this: hypocrisy. I do believe markets and the market mechanism are amazing things. And when properly regulated, overseen, transparent and when all the true costs are included the market mechanism is the greatest wealth creation machine there is. But, it must be allowed to function as reasonably free and unfettered on the upside as well as the downside.

That's where the hypocrisy comes in for me. All this palavering about short-sellers is just the tip of the iceberg. But it's the most prominent complaint we're hearing about right now. Why is it ok to have a market that always goes up, but not one that goes down? What's free about that? Again, this is just the tip of the iceberg. Short-sellers aren't the enemies here, they serve a very useful purpose, much like culling a herd of the weak. No, it ain't a pretty business--just ask any hunter or farmer, but it's a damned vital one. And the powers that be show just how hypocritical they are when they talk about the evils of the short sellers.

Let them short!

What's even more worrisome are the absolutely staggering levels of government intervention in our financial markets. Enough is enough! We can nationalize the nation's largest insurer but not have national healthcare? Good grief!

They should have let Bear Stearns fail. (Not Fannie and Freddie, however, as there is and was an implicit Federal guarantee, but the way it was done by wiping out shareholders in favor of a certain class of bondholders was the wrong way to go about it; just goes to show you what happens when you have a 'bond-man' like Hank Paulson at the helm.)

They should have let AIG fail. They should let every Wall Street institution with a poor balance sheet fail. They all deserve to fail if they didn't hedge their risk properly and save for a rainy day.

But the rich? Well, they own the country. They own our government. The financiers, the paper-wealth pushers and the bond-men who spent the better part of a decade getting us into this mess are now terrified of losing their ill-gotten gains and they are using every lever of the government, your government, which they own, to protect their wealth.

As for the future: we won't see any meaningful or helpful regulation until the markets are allowed to fall, freely. We certainly won't get it under a McCain Administration (imagine Phil Gramm as Treasury Secretary, terrifying, eh?). And I don't think we'll get meaningful regulation under an Obama one either--most likely a reactionary overshoot, instead of thoughtful and studied reforms (no, I'm not calling for a McCain-like 9/11 Commission). But, I'm convinced the markets need to be allowed to clear this out, without government intervention. We can't avoid a Japan-like lost decade. It's too late. And all the intervention in the world does is forestall the day of reckoning. There is too much risk in the system and it needs to be cleared out.

Let it burn! We're all going to suffer, regardless.

| |

[more]

You Know The Banking System Is Unsound When....

|

1. Paulson appears on Face The Nation and says "Our banking system is a safe and a sound one." If the banking system was safe and sound, everyone would know it (or at least think it). There would be no need to say it.

| |

[more]

Report: Regulators Looking for a Buyer for WaMu

Insanity is Doing the Same Thing and Expecting Different Results: Real Reform Means Reinstituting Glass-Steagall at Full Strength and Breaking Up Financial Conglomerates

|

Ok, enough already. I'm sick of people talking about modern markets as if they are something wonderful. No, they aren't. Obama is absolutely right, they completely fell down on their job, not just for the last 8 years, but for most of the last 28 —whenever Republicans were in charge, and a fair bit when Dems were in charge. Ordinary people haven't had a raise in damn near 30 years. This is success?

| |

[more]

china/america

This is a remarkable series on China and America done in the UK but with photographs by American photographer Alec Soth.

America and China: The Eagle and the Dragon

Part one: Freedom fighters

With a $3 trillion war bill and an economy that flounders as China's soars, could America's era of dominance on the world stage be coming to an end? Mick Brown and the photographer Alec Soth travelled across America and China to observe how the future of these two great nations is intertwined, and to find out whether, in the run-up to the Beijing Olympics and the US election, we are on the brink of a new world order. In the first of a four-part series, they meet army recruitment officers in Virginia and cadets at West Point

|

Not least among the challenges faced by the US military in prosecuting the war has been maintaining a full and motivated fighting force at a time when popular sentiment against the war in Iraq is running at an all-time high.

America has had a volunteer army since the abolition of conscription by Congress at the end of the Vietnam War in 1973. But the drip-feed of news images of car bombs in Baghdad and body-bags returning from Afghanistan is not a good advertisement for recruitment. By the US Army's own admission, the desire to enlist is currently at its lowest point in two decades, with the army struggling to make the required 80,000 new recruits each year; while the cost of recruiting has never been higher - more than doubling in the 20 years between 1975 and 2005 from around $7,000 per enlistee to $16,000.

A disproportionately high number of these recruits come from rural communities, where job opportunities tend to be lower, and patriotic feeling runs higher. According to a study by University of New Hampshire's Carsey Institute the death rate for rural soldiers is 60 per cent higher than for soldiers from cities or suburbs: 'The dearth of opportunity in rural areas simply leaves more young people with fewer alternatives to the military,' the study notes. 'The opportunity differential between rural and urban America is probably higher now than at any time in the past.'

Nowhere is this mixture of rural hardship and patriotic sentiment more evident than in the neighbouring Appalachian states of West Virginia and Virginia.

Nowhere is this mixture of rural hardship and patriotic sentiment more evident than in the neighbouring Appalachian states of West Virginia and Virginia.

This had once been a flourishing mining area, but mining was in decline and many of the small communities and townships wore a used-up, sorrowful look; it seemed the only thing that continued to flourish here was faith. In Bradshaw, West Virginia - windblown and desolate - the Ten Commandments were posted in a square opposite the town hall, but even the pawn-shop had closed down.

| |

New recruits Kayla Smith, Lauren Martin and Priscilla Branch,

all aged 17, in the car-park of the Liberty Mall in Martinsville, Virginia,

where the US Army has a recruitment centre

[more]

thanks to Conscientious

America and China: The Eagle and the Dragon

Part Two: Requiem for a dream

Once symbolic of optimism and certainty, America's credit-crunched suburbs may be facing a decline as dramatic as that of Detroit, itself once a beacon of industry. Mick Brown and the photographer Alec Soth continue their investigation into the contrasting fortunes of the US and China

|

The birthplace of modern America - one might say the modern world - is a huge disused factory building that stands on a busy six-lane boulevard in a part of Detroit named Highland Park.

Outside, on a scrubby patch of untended grass, is a sign posted by the Michigan Register of Historic Sites stating that this was the factory where, in 1913, Henry Ford began the mass production of automobiles on a moving assembly line. By 1915 Ford had built a million of his Model Ts; by 1925 more than 9,000 were being assembled in a single day.

Mass production, the sign reads, soon moved from here to all places of American industry 'and set the pattern of abundance for 20th-century living'.

It is a wonderfully evocative phrase that stops you in your tracks - the pattern of abundance for 20th-century living. From here came the principles of mass production that provided the goods that fuelled the consumer society; from here, the automobile that begat the roads and the freeways that carried people and goods from sea - as America the Beautiful has it - to shining sea, and then to the world beyond.

The Highland Park factory was known as the Crystal Palace because of the amount of glass used in its construction. But its windows have long been shuttered and boarded. What remains of the plant is now used for warehousing, with one part given over to a retail outlet for a company selling cheap shoes made in China. Highland Park - a city within the city of Detroit - is so economically bereft that it can't even afford its own police department - the county police patrol there instead.

| |

As the birthplace of mass production,

Detroit 'set the pattern of abundance for 20th-century living'

[more]

thanks to Conscientious

America and China: The Eagle and the Dragon

Part Three: onward and upward

The thrusting tower blocks of Chongqing stand testament to the headlong economic growth that is changing the lives of millions of Chinese. Mick Brown and the photographer Alec Soth continue their investigation into the contrasting fortunes of the US and China by exploring the world's fastest-growing city

|

It was while sitting at the table in Lei Jing's dining-room, in his neat little house on the outskirts of Chongqing, overlooking the plot of land that his family had tended for generations, that the message of China's extraordinary economic boom became clear. We had driven out from the city that morning, through the dense forest of new skyscrapers and tower blocks (many still swathed in scaffolding) that were sprouting up in every direction in readiness for the hundreds of thousands of people who arrive in Chongqing each year from the countryside in search of a new life. We had swept along the newly constructed freeways, past the new private developments enshrouded in hoardings offering the seductive promise of a better future - AIR GARDEN BABYLON: TOP GRADE BRAND IN WORLD; REFINE CHINESE WISDOM: BUILD ORIENTAL VOGUE; LIVE FOR PLEASURE AND WIN THE WORLD.

Lei Jing had not yet won the world, but his life had improved, he said, in ways nobody could have dared to imagine 30 years ago. He was 36 and worked as a test-driver for a local car manufacturer. During the first period of reforms in China, in the early 1980s, his family had acquired their first washing machine and television set. And now, in the period of the second reforms, he had been able to buy a car and to finance the building of the house where we were now sitting.

'Everything is improving in China, especially material life. I am very proud of what is happening in my country.'

This, I said, was undoubtedly a good thing, but - how could I put this diplomatically? - what troubled many people in the West was the fear that China's newfound prosperity was being secured at our expense; in jobs, rising fuel prices, the cost to the environment. Lei Jing was an equable man, but a note of incredulity crept into his voice. 'That's not the case!' he said. 'The Chinese culture is such that we feed ourselves and are satisfied with ourselves and our own environment. China does not intend to be a threat to the Western nations.' Lei Jing gave a polite smile. 'We don't want much. Only what everyone wants.'

| |

Chongqing's authorities plan to move two million people from the countryside

into newly developed areas such as this within five years

[more]

thanks to Conscientious

America and China: The Eagle and the Dragon

Part Four: Higher, faster, stronger

With the Beijing Olympics, China hopes to cement its position alongside the USA on the podium of global power. In the final part of their special investigation, Mick Brown and photographer Alec Soth examine how both nations are playing the Games

|

The new National Stadium in Beijing - the Bird's Nest, as it is known - an elaborate latticework, like stainless-steel macrame, is one of the great architectural marvels of the modern world. And its effect is to stun everyone who sees it into a moment of silence. Standing on the road abutting the stadium, and gazing towards it over a wooden fence, Mr Ling wore the expression of a man in the throes of something approaching rapture. He was from Beijing, he said, a civil servant, now retired. He was wearing a T-shirt emblazoned with the message I CAN BELIEVE THE WORLD. 'Emotionally,' he said, 'I feel more self-esteem and excitement than I have ever felt. I will remember this moment my entire life.'

China has a lot invested in the Olympic Games - and not only the $20 billion that has been spent on building the new sports stadiums, airport terminals, subways and other facilities that will serve the city in the long term. More significantly, it has the investment of national pride: $20 billion is roughly the same amount that, 40 years ago, the US spent on putting the first man on the moon - a demonstration to the world of the primacy of America and the capitalist way. The Beijing Olympics might be seen as China's moon-shot - the showpiece of the nation's emergence as a global power. From my hotel window I looked on to the CCTV Tower, the new headquarters of China's state broadcaster, yet another architectural marvel comprising two glass blocks in an inverted 'L' shape, fused into one vertigo-inducing structure. Below it a huge hoarding pictured a troop of soldiers marching purposefully beside a message in Chinese and English: TO PROVIDE A CLEAN ENVIRONMENT AND GOOD SERVICE FOR OLYMPICS - SERVING WITH HEARTS, MINDS AND SPIRIT.

| |

The Shichahai Sports School in Beijing, the flagship

of the Chinese government’s athletics training programme,

has about 600 pupils aged between six and 18

[more]

thanks to Conscientious

photography

This series is taken in Chongqing, China. They show an explosion of city development. There is nothing like that happening in the US. Here our bridges are falling down.

Ferit Kuyas: City of Ambition

[more]

thanks to Heading East

america the beautiful

What will America look like in two years?

by Joe Bageant

|

I can tell you a few conclusions at which I have arrived (without going into the years long process by which I arrived at them):

America is now a totalist state. This seems not so apparent because of the glossy "commercial skin" over everything. Shining goods, much meaningless commercial activity, the energy of every able person dedicated to profit making activity in the name of "the economy," which has become god, yet no one can define it except in the language of Wall Street and the stock market -- a faceless god in itself. Interestingly, the stock market goes up when people are paid less or more people are unemployed, etc., yet people have accepted its terms as the definition of their well being.

The rise of this state has required increased police forces and heavy-handed enforcement, thus we hold one-quarter of the world's prison population, though we are only six percent of the earth's population.

The elections are an illusion. A totalitarian state loves nothing more than elections, which gives the illusion of choice on the part of the people. The people, after so many generations of this illusory choice, believe it themselves.

America is already a second world nation, but the aforementioned shiny commercial skin and charming digital gizmos leads the citizenry to believe otherwise. No health care, no guarantee of anything really, except competitive struggle with one another for work and money.

Americans are presently comfortable because we have always been very materialistic from the beginning. And so comfort and goods have always trumped thought and morality. But now that natural resources are being heavily stressed globally, we are left without enough concern for the common good to save ourselves as a unified entity. The problem with American style democracy is that it is all well and good to say, "I owe no man anything. And no man owes me. I am free unto myself." And, unfortunately, alone. No grasp of the common weal. And so we are left to depend entirely upon the state to do everything man does collectively, while we are each left to seek out the latest personal comfort or amusement.

Neither comfort nor amusement are boundless. And never do they replace or fulfill the moral and philosophical.

There is indeed a sort of unease. But not nearly so much as you might think. And that unease is inchoate because the language needed to describe its causes has vanished into, or been neutralized by the state's economic consumer culture. There is almost no discussion of the meaning of anything, just the emotionalism managed by politics, marketing, etc.

| |

[more]

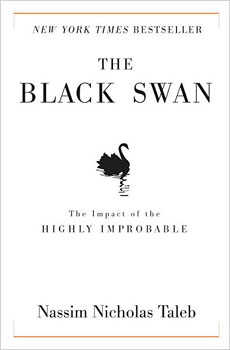

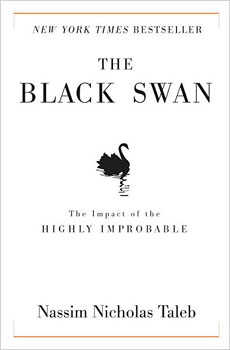

book recommendation

The Black Swan:

The Impact of the Highly Improbable

by Nassim Nicholas Taleb

This is a scary book. Taleb shows how our financial system is using mathematical constructs to minimize risk. Then he shows how highly improbable events come along and undo everyone's carefully laid plans. Here is the first chapter:

‘The Black Swan: The Impact of the Highly Improbable’

By Nassim Nicholas Taleb

|

Before the discovery of Australia, people in the old world were convinced that all swans were white, an unassailable belief as it seemed completely confirmed by empirical evidence. The sighting of the first black swan might have been an interesting surprise for a few ornithologists (and others extremely concerned with the coloring of birds), but that is not where the significance of the story lies. It illustrates a severe limitation to our learning from observations or experience and the fragility of our knowledge. One single observation can invalidate a general statement derived from millennia of confirmatory sightings of millions of white swans. All you need is one single (and, I am told, quite ugly) black bird.

I push one step beyond this philosophical-logical question into an empirical reality, and one that has obsessed me since childhood. What we call here a Black Swan (and capitalize it) is an event with the following three attributes.

First, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility. Second, it carries an extreme impact. Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable.

I stop and summarize the triplet: rarity, extreme impact, and retrospective (though not prospective) predictability. A small number of Black Swans explain almost everything in our world, from the success of ideas and religions, to the dynamics of historical events, to elements of our own personal lives. Ever since we left the Pleistocene, some ten millennia ago, the effect of these Black Swans has been increasing. It started accelerating during the industrial revolution, as the world started getting more complicated, while ordinary events, the ones we study and discuss and try to predict from reading the newspapers, have become increasingly inconsequential.

Just imagine how little your understanding of the world on the eve of the events of 1914 would have helped you guess what was to happen next. (Don't cheat by using the explanations drilled into your cranium by your dull high school teacher). How about the rise of Hitler and the subsequent war? How about the precipitous demise of the Soviet bloc? How about the rise of Islamic fundamentalism? How about the spread of the Internet? How about the market crash of 1987 (and the more unexpected recovery)? Fads, epidemics, fashion, ideas, the emergence of art genres and schools. All follow these Black Swan dynamics. Literally, just about everything of significance around you might qualify.

This combination of low predictability and large impact makes the Black Swan a great puzzle; but that is not yet the core concern of this book. Add to this phenomenon the fact that we tend to act as if it does not exist! I don't mean just you, your cousin Joey, and me, but almost all "social scientists" who, for over a century, have operated under the false belief that their tools could measure uncertainty. For the applications of the sciences of uncertainty to real-world problems has had ridiculous effects; I have been privileged to see it in finance and economics. Go ask your portfolio manager for his definition of "risk," and odds are that he will supply you with a measure that excludes the possibility of the Black Swan-hence one that has no better predictive value for assessing the total risks than astrology (we will see how they dress up the intellectual fraud with mathematics). This problem is endemic in social matters.

The central idea of this book concerns our blindness with respect to randomness, particularly the large deviations: Why do we, scientists or nonscientists, hotshots or regular Joes, tend to see the pennies instead of the dollars? Why do we keep focusing on the minutiae, not the possible significant large events, in spite of the obvious evidence of their huge influence? And, if you follow my argument, why does reading the newspaper actually decrease your knowledge of the world?

It is easy to see that life is the cumulative effect of a handful of significant shocks. It is not so hard to identify the role of Black Swans, from your armchair (or bar stool). Go through the following exercise. Look into your own existence. Count the significant events, the technological changes, and the inventions that have taken place in our environment since you were born and compare them to what was expected before their advent. How many of them came on a schedule? Look into your own personal life, to your choice of profession, say, or meeting your mate, your exile from your country of origin, the betrayals you faced, your sudden enrichment or impoverishment. How often did these things occur according to plan?

| |

[more]

Nassim Nicholas Taleb: the prophet of boom and doom

When this man said the world’s economy was heading for disaster, he was scorned. Now traders, economists, even Nasa, are clamouring to hear him speak

|

Last May, Taleb published The Black Swan: The Impact of the Highly Improbable. It said, among many other things, that most economists, and almost all bankers, are subhuman and very, very dangerous. They live in a fantasy world in which the future can be controlled by sophisticated mathematical models and elaborate risk-management systems. Bankers and economists scorned and raged at Taleb. He didn’t understand, they said. A few months later, the full global implications of the sub-prime-driven credit crunch became clear. The world banking system still teeters on the edge of meltdown. Taleb had been vindicated. “It was my greatest vindication. But to me that wasn’t a black swan; it was a white swan. I knew it would happen and I said so. It was a black swan to Ben Bernanke [the chairman of the Federal Reserve]. I wouldn’t use him to drive my car. These guys are dangerous. They’re not qualified in their own field.”

| |

[more]

economy

The US financial system continues it's slow motion collapse. Last weekend it was Fannie Mae and Freddie Mac. This weekend it's Lehman Brothers. What's next weekend? Washington Mutual? If they make until then. The Ponzi schemes continue to unravel. Why is no one going to jail?

Last Ditch

by Jim Kunstler

|

Why do the big deals always happen over the weekends? So the big boyz in government and finance can take off their neckties when they bargain with each other? So the markets will be closed and unable to register a response one way or another? So the shrinking fraction of the US public that pays attention to anything besides Nascar and pornography won't catch the news Saturday evening?

This weekend's big deal was the US government taking over the "government sponsored enterprises" (GSEs) Fannie Mae and Freddie Mac that guarantee trillions of dollars in mortgages. The "guarantee" is supposedly accomplished by converting bundles of mortgages from the banks and loan companies that originate them (that make the contracts with the buyers of houses) into bonds that can be sold downstream. Risk was theoretically dispersed among the holders of these bonds. This all seemed to work during the long stable period when our cheap oil economy was chugging along, and house prices maintained a consistent relationship with incomes, and people paid their mortgages dependably. The whole system ran like a reliable machine -- like a Chrysler slant-six engine!

Until the cheap oil age came to an end. Then, all parts of the system shook apart. It was the end of cheap oil that catalyzed the housing collapse and, by extension, the current huge financial crisis. But the run up to it was like a bounce off a high diving board into an empty pool. The bounce came around 2001 when it became apparent that the US standard-of-living could not be maintained on incomes in a post-cheap-oil economy. The trauma of 9/11 prompted a new and utterly insane consensus to form that the US standard of living could be switched over from income to massive debt. All the normal brakes against irresponsible lending and borrowing came off -- embodied in Alan Greenspan's absurd statement that it was a good time to assume an adjustable rate mortgage when interest rates were at a historic low -- meaning they could only be adjusted upwards. Why hold Greenspan responsible? Because he was at the apex of the authority vested with establishing norms, and he shoved our behavior into the realm of the recklessly abnormal, and he should have known better.

| |

[more]

Freddie and Fannie Bail-Out: Our Foreign Masters Have Spoken

|

The top five foreign holders of Freddie and Fannie long-term debt are China, Japan, the Cayman Islands, Luxembourg, and Belgium. In total foreign investors hold over $1.3 trillion in these agency bonds, according to the U.S. Treasury's most recent "Report on Foreign Portfolio Holdings of U.S. Securities."

China alone holds $376 billion in bond holdings.

Unless I am misreading something, foreign central banks will be protected, including China's...and the America taxpayer will foot that bill.

| |

[more]

Comrades Bush, Paulson and Bernanke Welcome You to the USSRA (United Socialist State Republic of America)

|

The now inevitable nationalization of Fannie and Freddie is the most radical regime change in global economic and financial affairs in decades. For the last twenty years after the collapse of the USSR, the fall of the Iron Curtain and the economic reforms in China and other emerging market economies the world economy has moved away from state ownership of the economy and towards privatization of previously stated owned enterprises. This trend was aggressively supported the United States that preached right and left the benefits of free markets and free private enterprise.

Today instead the US has performed the greatest nationalization in the history of humanity. By nationalizing Fannie and Freddie the US has increased its public assets by almost $6 trillion and has increased its public debt/liabilities by another $6 trillion. The US has also turned itself into the largest government-owned hedge fund in the world: by injecting a likely $200 billion of capital into Fannie and Freddie and taking on almost $6 trillion of liabilities of such GSEs the US has also undertaken the biggest and most levered LBO (“leveraged buy-out”) in human history that has a debt to equity ratio of 30 ($6,000 billion of debt against $200 billion of equity).

So now Comrades Bush, Paulson and Bernanke (as originally nicknamed by Willem Buiter) have now turned the USA into the USSRA (the United Socialist State Republic of America). Socialism is indeed alive and well in America; but this is socialism for the rich, the well connected and Wall Street. A socialism where profits are privatized and losses are socialized with the US tax-payer being charged the bill of $300 billion.

| |

[more]

Is there an exit strategy?

The idea that the world's largest economies are merely facing a short-term panic looks increasingly strained

|

A year into the global financial crisis, several key central banks remain extraordinarily exposed to their countries' shaky private financial sectors. So far, the strategy of maintaining banking systems on feeding tubes of taxpayer-guaranteed short-term credit has made sense. But eventually central banks must pull the plug. Otherwise they will end up in intensive care themselves as credit losses overwhelm their balance sheets.

The idea that the world's largest economies are merely facing a short-term panic looks increasingly strained. Instead, it is becoming apparent that, after a period of epic profits and growth, the financial industry now needs to undergo a period of consolidation and pruning. Weak banks must be allowed to fail or merge (with ordinary depositors being paid off by government insurance funds), so that strong banks can emerge with renewed vigour.

If this is the right diagnosis of the "financial crisis", then efforts to block a healthy and normal dynamic will ultimately only prolong and exacerbate the problem. Not allowing the necessary consolidation is weakening credit markets, not strengthening them.

The United States Federal Reserve, the European Central Bank, and the Bank of England are particularly exposed. Collectively, they have extended hundreds of billions of dollars in short-term loans to both traditional banks and complex, unregulated "investment banks". Many other central banks are nervously watching the situation, well aware that they may soon find themselves in the same position as the global economy continues to soften and default rates on all manner of debt continue to rise.

| |

[more]

Lehman Brothers May Need a Miracle to Survive

|

The Wall Street firm that started the U.S. cotton trade before the Civil War and financed the railroads that built a nation might soon fade into history.

Just days after Lehman Brothers Chief Executive Richard S. Fuld tried to pitch Wall Street on a plan to save the firm by shrinking it, he's in complicated negotiations with potential buyers that may see the company sold piecemeal as soon as Sunday night, analysts said.

"Nothing short of a miracle can save Lehman as is," said Anthony Sabino, professor of law and business at St. John's University. "It is highly unlikely Lehman will be in existence on Monday morning."

| |

[more]

Talks Continue in Effort to Rescue Lehman

|

The fate of Lehman Brothers, the beleaguered investment bank, hung in the balance on Sunday as Federal Reserve officials and the leaders of major financial institutions continued to gather in emergency meetings trying to complete a plan to rescue the stricken bank.

| |

[more]

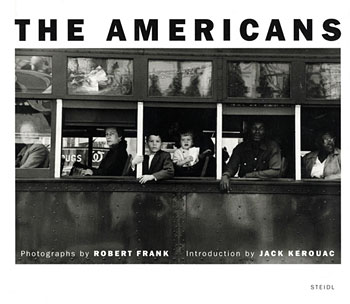

book recommendation

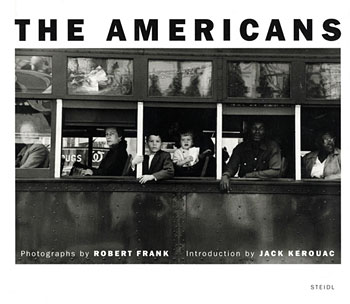

The Americans

by Robert Frank

The Americans is legendary. It's been out of print for a while and I had never seen it. Now we have a 50th anniversary edition that is probably the best edition yet. Beautifully printed. And what images! I can see why this has been called the most influential photo book ever. Anyone with any interest in photography must see this book. Now. From Amazon:

|

In this 50th anniversary reissue, celebrated photographer Frank maintains the format (left page: brief caption, right page: photo) and introduction (Jack Kerouac: "with the agility, mystery, genius, sadness and strange secrecy of a shadow Frank photographed scenes that have never been seen before on film"), the images themselves have been re-scanned, re-cropped by Frank and, in two cases, changed. Frank's images, taken all across the country, leave the viewer with a solemn impression of American life. From funerals to drug store cafeterias to parks, Frank recorded every shade of everyday life he encountered: the lower and upper classes, the living and dead, the hopeful and destitute, all the while experimenting with angle, focus and grain to increase impact. Preceding an exhibition that will tour U.S. galleries in 2009, this volume will no doubt introduce new generations to Frank's inimitable record of daily life fifty years ago. Kerouac says, fittingly, that "after seeing these pictures you end up finally not knowing any more whether a jukebox is sadder than a coffin"; those who don't comprehend Kerouac's comment have yet to experience this classic collection.

| |

Photo-Eye has several articles on The Americans.

The Americans 50th Anniversary

|

Robert Frank's The Americans is vital to the here and now—as vital to the present moment as it was fifty years ago upon first publication. This is all you need to know. The rest, as they say, is commentary. Around the time I turned 40 in 1985, I began to read classics I had not gotten around to, was never assigned, or could not penetrate as a reader with no agenda. Books become classics not because teachers assign them. A book becomes a classic when it speaks to readers or viewers, across time, across politics—when it is the rare enduring expression of a unique consciousness so rooted in its own time and place that time is transcended: a voice from the past that speaks to a reader in the present. The Americans is such a book, no less so than Moby Dick or Madame Bovary.

| |

[more]

Robert Frank, Gunslinger with Camera

|

Robert Frank is generally not interested in being profiled in print. Publicity is a double-edged sword and when you've had your fill—it can often cut the other way—even a mohel's hand can slip.

In 1947 Robert Frank arrived in New York from Switzerland with his camera. His first photo job was shooting Moe, Larry and Curly—The Three Stooges—on a bus tour from high school to high school in Queens.

At each stop the Stooges disembarked to a throng of high school students and the Stooges would play their antics—punch each other's eyes out, pratfalls—etc. Back on the bus, Frank told me, the Stooges would speak of the boys and girls with absolute contempt.

Welcome to America.

| |

[more]

Robert Frank

by Walker Evans

|

Assuredly the gods who sent Robert Frank, so heavily armed, across the United States did so with a certain smile.

Photographers are often surprised at some of the images they find on their films. But is it an accident that Frank snapped just as those politicians in high silk hats were exuding the utmost fatuity that even a small office-seeker can exhibit. Such strikes are not purely fortuitous. They happen consistently for expert practitioners. Still, there remains something mysterious about their occurrence, for which an analytical onlooker can merely manufacture some such nonsensical phrase as "the artist’s crucial choice of action."

But these examples are not the essence of Frank’s vision, which is more positive, large, and basically generous. The simple picture of a highway is an instance of Frank’s style, which is one of the few clear cut signatures possessed by any of the younger photographers. In this picture, instantly you find the continent. The whole page is haunted with American scale and space, which the mind fills quite automatically—though possibly with memories of negation of violence or of exhaustion with thoughts of bad cooking, extremes of heat and cold, law enforcement, and the chance to work hard in a filling station.

| |

[more]

Members of the photography world on Robert Frank and The Americans

Robert Frank’s Unsentimental Journey

Published in 1958, Robert Frank’s photographic manifesto, The Americans, torched the national myth, bringing him such comrades as Jack Kerouac, Allen Ginsberg, and—for a controversial documentary—the Rolling Stones. On a trip to China, the 83-year-old rebel of postwar film still defies expectations.

|

Robert Frank, the photographic master, the last human being it’s been said to discover anything new behind a viewfinder, collapsed in a filthy Chinese soup shop and no one had thought to bring along a camera.

| |

[more]

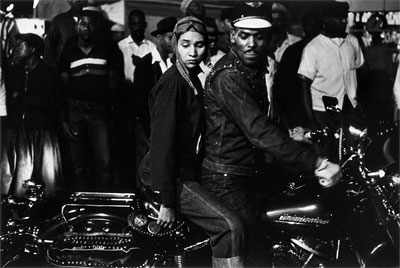

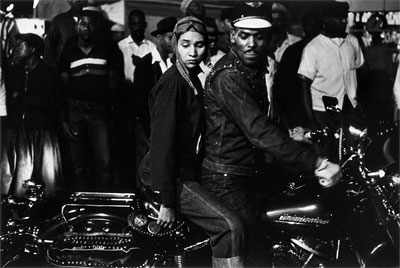

They didn't know they were famous

51 years later, Indy couple ID'd as faces in iconic photo

|

Robert Frank, meet Mack and T Smiley.

The mystery couple in the photograph taken in Indianapolis 51 years ago by Frank for his seminal book, "The Americans," have been identified as Matthew and Telester Smiley, known to all their friends as Mack and T.

Several relatives and acquaintances recognized them in the photo published in Sunday's Indianapolis Star and brought it to the attention of Telester Smiley, now 76.

On Tuesday, she pored over pictures of her husband at her Northwestside home, showing him with his beloved Harley-Davidson motorcycle. Mack Smiley passed away in 1996 at age 69. They were married for 47 years.

"He was crazy about that motorcycle," she said.

| |

[more]

|

|

|

|