|

| |

Archives

economy

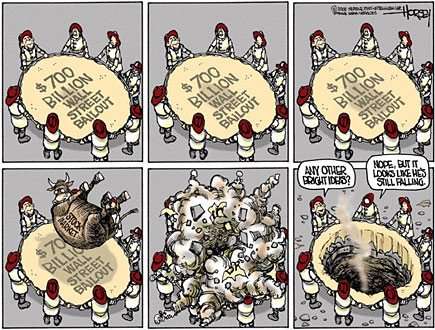

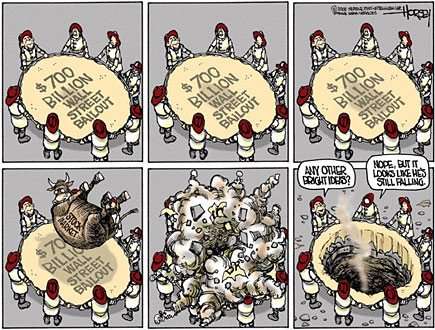

Very busy but I couldn't resist this.

David Horsy

[more]

economy

I've only put up links on the economy this past couple of weeks because there is nothing happening that is more important. I've seen a lot of history in my life (64 years of it) but nothing as big as this. The collapse has spread to Europe. The Dow is under $10,000. The shit is hitting the fan. And our fearful leaders have no fucking clue. It should be an interesting week.

All Fall Down

by Jim Kunstler

|

God knows what manner of deals went down this past weekend in the Hamptons wine cellars and below-decks among the Chesapeake Bay sailboat fleet. All these hidey-holes must have been dank and fetid with the sweat of mortal fear. Will the US Government declare itself a subsidiary of General Electric? Will Vlad Putin be roped in to save Goldman Sachs? Meanwhile, the whole noisome rat maze of international counter-party deals was taking on sewer water and rodents of every nationality were seen leaping for daylight all over the fusty old motherlands of Europe. A cascading collapse of international finance is underway. While many fixers may jump heroically into the tumbling wreckage hoping to rescue this-and-that, the outcome by Friday is liable to be an unrecognizable smoldering landscape of the G-7's hopes and dreams.

Some big questions for the week: will the Euro survive as a currency? Will the rush into the US dollar continue even as the US financial system dematerializes in a Fibonacci fever of accelerating de-leveraged infinitude? Will the remaining Big Boyz, Goldman Sachs and JP Morgan succumb to the counter-party hemorrhagic fever? Will great rows of lesser banking dominoes now start clacking onto their faces? Will all fifty states follow the leads of California and Massachusetts and line up at the US Treasury's hand-out window. Will the entity that calls itself the civilized world be left at week's end with anything resembling money?

Your guess is as good as mine. We've entered the realm of phase change, where everything is slipping and nothing has settled. The final result, when the dust settles -- and that may not be for weeks to come -- will certainly be a poorer western world. Will it be so poor that it can no longer afford to import anything? Including oil from the land of the date palm? If so, we are really in for a rough ride, poised as we are at the edge of the heating season here in the temperate regions. Notice, by the way, that the $700 billion just approved by congress to bail out Wall Street is exactly the same sum of money that we send to the oil exporting nations this year.

| |

[more]

Economic Consequences of the Bailout Plan

|

I'm not going to go through this in detail, but just quickly hit the highlights then discuss what this will mean for ordinary people and the economy.

Fundamentally it's the Treasury Secretary to spend pretty much as he chooses, with meaningless oversight, up to 700 billion or the debt limit. In theory it's "whichever is less" in practice it's going to be "whichever is more". Add to this the end of mark to the end of mark to market, and the move to mark to "whatever the bank says its worth" and banks are going to be allowed to stay alive no matter whether they're solvent or not as long as their cash flow doesn't go so far negative it can't be papered over the world's favorite wallpaper, the US buck. Zombie banks plus all the money flooding into trying to stop deleveraging from wiping out said financial institutions means this is a Japanification plan.

Japan had its own bubble back in the 80's. When it popped the Japanese decide that they would not force banks to write down their losses. Instead they left them on the books. Those of you who are old enough will remember when Japan was the economy of the future, who built the best stuff and were destroying everyone else. After the bubble popped that all ended. The world's most vibrant economy went into a long economic slump from which it never recovered. This wasn't a classic depression—there wasn't a huge immediate contraction. Things just generally got lousy - unemployment rose somewhat, jobs stagnated, no one had a lot of money. The good times never, ever, came back ever again. It was like being caught in a low grade recession, all the time.

[...]

And there are some ways this could be fixed. A lot of economists, like Stiglitz, are betting that Obama will eventually do a real bailout bill. We'll see. He made no real push to fix this bill at all that I am aware of and his various economic policies have long indicated to me that he is essentially a gentler kinder Reaganite in economic terms, so I'm not so sure. Still, there are solutions, and I'll talk about some of them in future, as I have in the past. The question is whether there will be any political will to do them. When you can pass a 700 billion bailout for the rich, but putting in real changes in bankruptcy laws to allow folks to keep their houses is unthinkable, it's clear that the elite consensus is still that the little people are always to be made to pay to clean up their betters mistakes. Until that attitude changes, very little useful is likely to get through Congress.

Everyone will be very interested in this again soon enough. In the meantime I wish you all, my readers, the best of luck and good health. I will repeat my standard advice that the most important thing in an economic downturn, by far, is not so much which securities your money is in, but how good your relationship is with your family, friends, neighbors, and most especially, your spouse.

| |

[more]

“That Future You Sold?” said the Devil, “I’m here to collect”

|

For years people like me have been saying "this can't go on forever" and for years people have been ignoring us. "Hey, why can't we live beyond our means forever? The credit card nations will never cut us off."

You're cut off. You owe more than you can pay. The 700 billion+ bill was just the first attempt by your creditors to get some money out of you. As I've noted before, it's not an accident that that foreign banks can sell their crap to you at above market prices. That's because you sold them that crap and they want to recoup some of their losses.

It's not an accident that China (your number one creditor) told its banks to stop lending to American banks. China wants some of its money back. It knows it isn't going to get most of it back, but what it can get back, it will.

There ain't no such thing as a free lunch. Now is when the US pays for all those years of selling paper and the future for real stuff now. The US figured it'd pay later.

Later is now.

The future is here.

And the Devil wants what you promised him.

Your future.

| |

[more]

Edge of the Abyss

by Paul Krugman

|

As recently as three weeks ago it was still possible to argue that the state of the U.S. economy, while clearly not good, wasn’t disastrous — that the financial system, while under stress, wasn’t in full meltdown and that Wall Street’s troubles weren’t having that much impact on Main Street.

But that was then.

The financial and economic news since the middle of last month has been really, really bad. And what’s truly scary is that we’re entering a period of severe crisis with weak, confused leadership.

The wave of bad news began on Sept. 14. Henry Paulson, the Treasury secretary, thought he could get away with letting Lehman Brothers, the investment bank, fail; he was wrong. The plight of investors trapped by Lehman’s collapse — as an article in The Times put it, Lehman became “the Roach Motel of Wall Street: They checked in, but they can’t check out” — created panic in the financial markets, which has only grown worse as the days go by. Indicators of financial stress have soared to the equivalent of a 107-degree fever, and large parts of the financial system have simply shut down.

There’s growing evidence that the financial crunch is spreading to Main Street, with small businesses having trouble raising money and seeing their credit lines cut. And leading indicators for both employment and industrial production have turned sharply worse, suggesting that even before Lehman’s fall, the economy, which has been sagging since last year, was falling off a cliff.

| |

[more]

Still on the Edge of the Abyss

|

Years from today, when the current financial crisis is over, historians are likely to agree that it would have been far better if the Bush administration had declared a state of emergency earlier in the process so that the necessary steps could have taken to avoid a complete financial meltdown. The media could have been used to bring the American people up to date on market-related developments and educated in the bizarre language of structured finance. Knowledge is power; and power can prevent panic.

Now we're in a terrible fix. People are scared and removing their money from the banks and money markets. This is intensifying the freeze in the credit markets and driving stocks into the ground like a tent stake. Meanwhile, our leaders are caught in the headlights, still believing they can finesse their way through the biggest economic cataclysm since the Great Depression.

If something is not done to increase the flow of credit immediately, the stock market will tumble, unemployment will spike, and many businesses will grind to a standstill. We could be just days away from a severe shock to the system. Secretary of the Treasury Henry Paulson's $700 billion bailout does not focus on the fundamental problems and is likely to fail. At best, it puts off the day of reckoning for a few weeks or months. Contingency plans should be put in place so the country does not have to undergo post-Katrina bedlam.

Does Congress have any idea of the mess they've made by passing the Bailout bill? Did any Senator or congressperson voting Yes even notice, that while they were busy mortgaging off America's future, the stock market was plummeting to new lows? Between the time the ballots were cast on Paulson's bailout, and the announcement of the final tally (which was approved by a generous margin) the market went from a 310 point gain to a 157 point loss; a 467 point plunge in less than two hours.

Thus spake the Market: "Paulson's bill is a fraud!"

| |

[more]

Get Your Dollars Out Now! FAST!!!

|

The events of the last two weeks have clearly revealed that the global financial, monetary and banking system imposed on the world by the power structures promoting "globalization" is fundamentally flawed, unviable and immoral in its effects upon the most all of Mankind. After allowing a small cabal of shady characters to illegitimately accumulate vast amounts of wealth and power over markets, corporations, industries, media, armed forces and entire nations, like the World Trade Center towers on 9/11, this entire System is now in free-fall, collapsing into itself in one massive implosion.

This loathsome and unjust Global Power System was designed and implemented over the past seven decades by the geopolitical and geoeconomic strategic planners serving the New World Order power structures, most notably its network of discrete, low-profile but highly powerful private think tanks, such as the Council on Foreign Relations (CFR, founded in New York in 1919), The Trilateral Commission (founded in 1973), The Bilderberg Conference (formed in Holland in 1954), and others like the Cato Institute, American Enterprise Institute (AEI), and the notorious Neo-con Project for a New American Century (PNAC) (1).

Considering the enormous complexity of the process that is taking place right now; the vast amounts of information we are bombarded with every minute of the day, and the apparent difficulty in foreseeing just how this global crisis will finally be resolved, we would summarize certain important aspects and key data which we believe will help us put together this veritable jig-saw puzzle, so that we may begin to fathom what the true face of this horrendous creature euphemistically called "globalization", is really like. As Argentine citizens, we have a huge advantage over other peoples including US citizens when it comes to understanding and coping with this kind of crisis. I say this because in our own lifetimes we have suffered in Argentina all of what is now happening globally - albeit on a much smaller scale in our case. We've seen this movie... We've been there, and done that... We've been pushed and dragged through the entire hysterical hocus-pocus of inflation, hyperinflation, systemic banking collapses, currency changes, Debt Bond Swaps, Mega-Debt Bond Swaps, financial "armouring", banking holidays, freezing of bank accounts, etc., etc... And we have also suffered the end-results: bank bail-outs paid for by taxpayers (or through inflation, or through the confiscation of savings), disappearance of pension funds, destruction of job posts and overall impoverishment of the population.

Considering the enormous complexity of the process that is taking place right now; the vast amounts of information we are bombarded with every minute of the day, and the apparent difficulty in foreseeing just how this global crisis will finally be resolved, we would summarize certain important aspects and key data which we believe will help us put together this veritable jig-saw puzzle, so that we may begin to fathom what the true face of this horrendous creature euphemistically called "globalization", is really like. As Argentine citizens, we have a huge advantage over other peoples including US citizens when it comes to understanding and coping with this kind of crisis. I say this because in our own lifetimes we have suffered in Argentina all of what is now happening globally - albeit on a much smaller scale in our case. We've seen this movie... We've been there, and done that... We've been pushed and dragged through the entire hysterical hocus-pocus of inflation, hyperinflation, systemic banking collapses, currency changes, Debt Bond Swaps, Mega-Debt Bond Swaps, financial "armouring", banking holidays, freezing of bank accounts, etc., etc... And we have also suffered the end-results: bank bail-outs paid for by taxpayers (or through inflation, or through the confiscation of savings), disappearance of pension funds, destruction of job posts and overall impoverishment of the population.

| |

[more]

|

|

|

|